We're available Monday to Friday from 8 a.m. to 6 p.m. eastern time.

Need help right now? Call 1-800-431-9025.

The 2025 Quickfinder Tax Tables for Business will be available in December 2025. Pre-order your Handbook today.

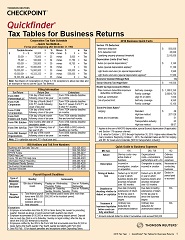

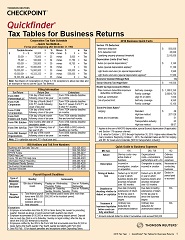

Quickfinder Tax Tables for Business Returns is a durable, laminated fold-out tool that provides the Quickfinder tables and charts you use most often, allowing you to quickly answer client questions without flipping through pages. Keep important tax facts and figures at your fingertips with the Quickfinder Tax Tables!

Tax Tables for Business Returns includes these often-needed tables, and more:

Quickfinder Tax Tables are easy to take with you wherever you go, so you'll never be without the key tax information at your fingertips.

See information above for new edition availability. To order the current or prior tax year editions, please call us at 800-431-9025.